Copy-Trading

Benefit from our market experience – simple, transparent, and professional!

- 50,- / position request

Global Markets Sunday News

Volatilität auf allen Ebenen

Despite short-term records on the US stock markets, the financial markets were nervous this week after some companies, such as Microsoft and SAP, published disappointing figures in Europe. Commodities and foreign exchange were very volatile, and inflation in the US appears to be persistent. The appointment of Kevin Warsh as head of the US Federal Reserve in a few weeks’ time could have a positive effect. However, uncertainty is likely to persist, especially as the reporting season is not yet over.

Tops of the week

OHB +72,83 %: The German aerospace and technology group recorded a significant rise in its share price after confirming talks with Rheinmetall about participating in future public tenders for a military satellite network in low Earth orbit. The reason for investor enthusiasm is the consolidation of the European aerospace industry, in which OHB does not want to be left behind.

Seagate +17,8 %: Shares in the storage solutions provider rose over the course of the week. The company reported better-than-expected financial results and a solid outlook, which is primarily driven by demand from data centers and AI. Several other memory chip manufacturers, including Sandisk, also performed well.

Fugro +21,86 %: The share price of the geodata specialist rose, not least due to more positive assessments by analysts. Oddo BHF upgraded the stock to “outperform” and raised its price target. Jefferies also revised its rating upward to “hold” and increased its price target. The market sees this as a sign of existing upside potential.

Puma +16,97 %: Things started looking up for the German sporting goods manufacturer after Anta acquired a stake in the company by purchasing shares held by the Pinault family. The market is betting on the strategic shareholder, which is expected to drive growth in China in particular. However, enthusiasm is currently somewhat subdued as the takeover has not been completed.

Royal Caribbean +13,47 %: After the cruise giant presented solid figures and an outlook for 2026 that exceeded expectations, the share price received a boost. The company anticipates continued very strong demand. Strategic announcements (approved joint venture in Japan, orders for new ships) and raised analyst estimates also contributed to the price increase.

Nexity +15,69 %: The French real estate company benefited from the inclusion of a government measure to stimulate housing construction and investment in rental apartments in the draft finance bill. The market now sees greater forecast certainty for the sector again.

Fnac Darty +17,36 %: The share price rose during the week after a friendly takeover by the EP Group of Czech billionaire Daniel Kretinsky was announced. This is unanimously supported by the Board of Directors and is seen as a defensive response against the backdrop of a changing shareholder structure.

ABB +11,55 %: The energy and automation technology group benefited from incoming orders (nuclear power in Canada, geothermal energy in the US), solid business figures and forecasts, and the announcement of a share buyback program. The share price performance also benefited from raised targets and a buy recommendation from analysts at Kepler Cheuvreux.

Flops of the week

Dometic -22,98 %: The Swedish manufacturer of caravan installations and camping equipment greatly disappointed the market with its results for the last quarter of 2025. The difficult consumer environment prompted investors to exercise caution.

UnitedHealth -19,46 %: US health insurers were severely punished after Donald Trump announced only a minimal increase in reimbursement rates for the Medicare Advantage program for 2027. The market had expected an increase of 5 to 6%, but the Trump administration announced only a 0.09% increase. As a result, insurers were forced to revise their forecasts downward in the middle of the reporting season.

Medincell -22,74 %: The sales figures published by the French biotech company for the drug Uzedy, marketed by Teva, were disappointing as they fell short of forecasts. The royalties that Medincell can earn are staggered depending on sales.

Eramet -15,17 %: Despite the potential offered by the possible monetization of Eramet Lithium’s assets, analysts at Portzamparc consider the recent rise in the mining and metallurgy group’s share price to be excessive. With a target price of EUR 58, the research firm lowered its recommendation from hold to reduce.

SAP SE -13,82 %: Although the group published solid figures for the 2025 financial year, the market questioned the robustness of the business in light of the AI boom. Overall, software providers continue to suffer from competition from hardware manufacturers. The market sees the latter as being better positioned in the short term to generate profits with AI.

Fresnillo -11,18 %: Although the gold and silver mining company exceeded its gold production targets for 2025, it has nevertheless revised its production forecasts for 2026 downward. The price rally that has been ongoing for several months is raising high expectations among investors – and rightly so.

Signify -16,23 %: The Dutch lighting solutions provider published weak annual figures and intends to turn things around after a thorough review of its business. The cost-cutting program announced at the same time was apparently not enough to reassure the market.

Microsoft -7,65 %: The Azure cloud division grew by 39% in the reporting quarter, slightly weaker than in the previous quarter (+40%). The still quite good figures cannot hide the fact that the market is critically questioning the future growth potential in a particularly competitive sector.

Waw materials

Energy: Oil prices closed extremely firm at the end of the month. The price of North Sea Brent briefly exceeded the symbolic threshold of USD 70, reaching its highest level since August last year. It has risen by around 14% since the beginning of the year, with the US benchmark WTI following close behind. The latter is currently trading at around USD 65 per barrel. The increase is mainly due to the deterioration in relations between the United States and Iran. US President Donald Trump has increased pressure on Tehran over its nuclear program and threatened military action. The deployment of US ships to the region has fueled investor nervousness. The Strait of Hormuz, through which 20 million barrels of crude oil are transported daily, is most at risk. Against this backdrop of volatility, OPEC+ members will meet for their next meeting on Sunday. According to several delegates, the cartel is likely to decide not to increase production volumes in March.

Metals: After reaching historic highs on Thursday, prices for copper, gold, and silver underwent a significant correction on Friday. This was due to massive profit-taking in light of the recovery of the US dollar and developments in monetary policy expectations in the US. On Thursday, the price of copper broke through the USD 14,500 per ton mark for the first time. On this trading day, the metal rose by 11%. On Friday, however, the trend reversed. The price fell to $13,465, down 1.1% within the trading day. Nevertheless, copper is still up about 6% since the beginning of the month. Fundamentals remain solid, as supply is limited and structural demand is high. Gold and silver also gave up some of their recent gains. Gold hit a new record high of $5,595 per troy ounce on Thursday. It then fell 7% to around $5,030 on Friday. Silver saw a more significant correction. After hitting a historic record high of $121.65 per troy ounce, the price slumped by more than 16% and fell below the $100 mark. Donald Trump has nominated Kevin Warsh as the new Fed chairman. The markets assume that Warsh is rather skeptical about aggressive interest rate cuts. This assessment supports the US dollar, and a stronger dollar makes metals more expensive for investors who pay in other currencies, which in turn puts downward pressure on prices.

Agricultural commodities: Wheat remains on the rise in Chicago. Freezing temperatures threaten winter harvests in Ukraine and the US. In Russia, the world’s leading exporter, exports are being delayed by poor weather conditions at Black Sea ports, causing export prices to rise. Against this backdrop, the price of wheat performed well throughout the week and is now trading at around 542 cents (contract maturing in March 2026).

Macroeconomics

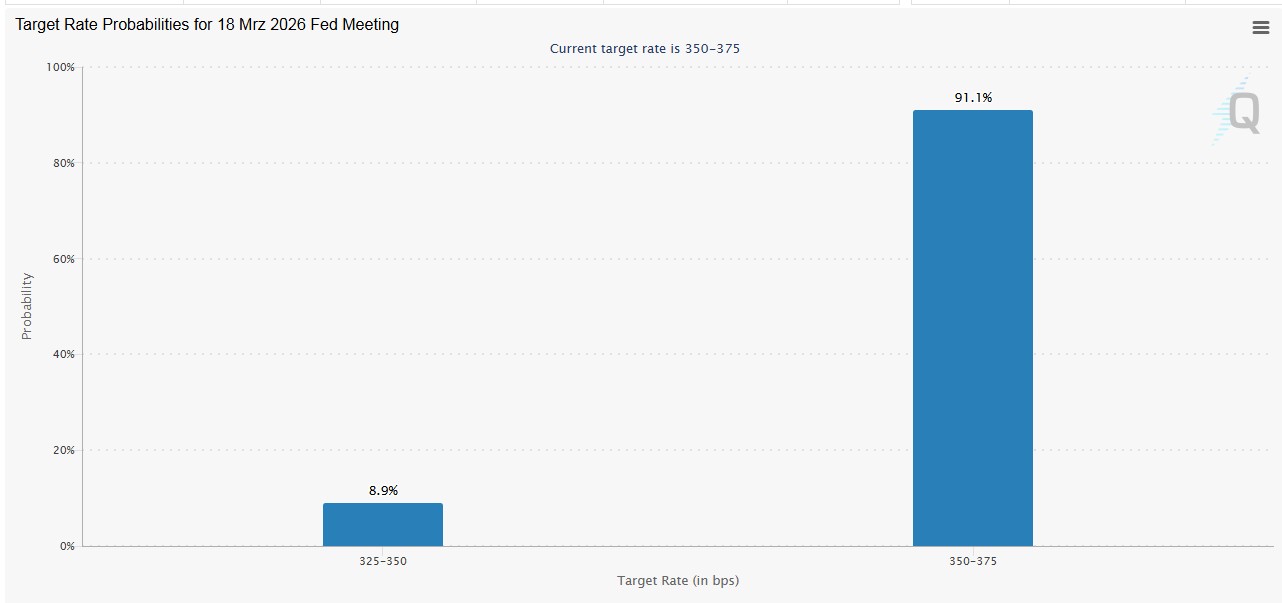

Market sentiment: News is coming thick and fast, causing unrest in financial markets. Microsoft’s results were disappointing and triggered significant price losses on the stock markets. Precious metals, on the other hand, saw profit-taking after a particularly good start to the year. The US Federal Reserve maintained the status quo at its last Open Market Committee meeting. In addition, Donald Trump nominated Kevin Warsh on Friday to succeed Jerome Powell at the helm of the Fed. The US dollar reacted positively to the nomination. Long-term US yields declined slightly, although the trend for ten-year US government bonds remains positive at over 4.20%.

Cryptocurrencies: Another bad week for Bitcoin: The market-leading cryptocurrency has slipped by almost 5% since Monday, after already losing 7.5% in the previous week. This means that BTC lost over $10,000 in value in just one week. On Thursday alone, Bitcoin spot ETFs recorded net outflows of more than $817 million – the weakest trading day for listed products since November 20 and the fourth-worst day since their introduction in early 2024. The main reason for the weakness is an unfavorable macro-financial environment. In recent weeks, geopolitical tensions have increased again, particularly in connection with Trump’s threatened tariffs and expansionist ambitions. At the same time, risk assets – and crypto assets in particular – came under increasing pressure amid fears of an AI bubble. In the past, cryptocurrencies have performed well, especially in an environment of low interest rates, a calm geopolitical situation, and high risk appetite. In 2026, however, we are still a long way from such a constellation. As is often the case, the downward trend of BTC also dragged the rest of the crypto market down. Ether (ETH) fell 2.5% to around $2,700, Solana (SOL) lost 2% and closed at $116. XRP also slipped 5% to around $1.76.The dollar reacted positively to the nomination. Long-term US yields declined slightly, although the trend for ten-year US government bonds remains positive at over 4.20%.

Outlook

Risk assets, from equities to commodities to foreign exchange, are once again experiencing volatility. Nervousness surrounding the US dollar following contradictory statements from the Trump administration, turmoil on the Japanese bond markets, speculation about precious metals, and mixed signals from corporate earnings are causing confusion. The nomination of Kevin Warsh, who is set to replace Jerome Powell as Fed chair in a few weeks, has been welcomed or at least seen as a less extreme solution compared to the other candidates.

Corporate earnings were mixed. The heated debate about the profitability of investments in artificial intelligence continues unabated, sending technology stocks on a rollercoaster ride.

Next week, Palantir, Walt Disney, AMD, Alphabet, Eli Lilly, Novartis, BNP Paribas, and Amazon are scheduled to report their latest figures.

In terms of economic data, the ECB’s interest rate decision (Thursday) and the monthly US labor market figures (Friday) are eagerly awaited.